It is the greatest thing you can do for children to teach them money management. If they pick good money habits at an early age, it will affect how they save, spend, and manage financial troubles as they grow up. Here are 10 effective ways to empower youngsters to cultivate money-wise habits and be confident about the future.

10. Engage Schools and Community Organizations

Children learn best when money education is supported both at home and in school. Most schools incorporate financial literacy into the curriculum, but parents can build on these teachings by promoting involvement in after-school programs, workshops, or community activities related to managing money. Materials from groups such as the Federal Reserve, the FDIC, and the National Credit Union Administration provide free games, lesson plans, and activities that make learning about money engaging and fun for everyone.

9. Be Open—But Age-Appropriate—About Family Finances

Open discussions of money de-mystify finances and lay the groundwork for lifetime financial security. For young children, it is sufficient to describe that you work to bring home money and that you decide how you spend it. As children age, they are capable of understanding more intricacies—such as why your household makes certain budget choices or how you save for large objectives. According to Cameron Huddleston, sharing your financial values and explaining spending decisions helps children become financially responsible adults. By the time your kids are teens or young adults, it’s helpful to discuss college costs, retirement planning, and even estate planning if appropriate.

8. Make Family Budgeting a Team Effort

Allow children to be involved in family budgeting to learn about trade-offs, priorities, and the existence of limited resources. Take them shopping for groceries with a predefined budget, shop prices together, or have them assist in planning a family event within a spending constraint. These practical experiences lead children to learn the value of money and the need for careful decisions.

7. Educate on Credit, Debt, and Sound Borrowing

Credit cards and loans are a reality for the majority of adults, yet many young people don’t become familiar with them until it’s already too late. Begin early by telling them that credit is a loan that has to be paid off, and that it can lead to costly debt if misused. Bankrate says that by teaching children to pay their balance every month, they avoid interest and establish a good credit score. Employ hands-on exercises, such as simulated shopping excursions or games involving budgeting, to demonstrate the functioning of interest and charges. For adolescents, explain credit ratings, balance transfer costs, and the need to read the fine print on financial items.

6. Employ Practical Exercises and Equipment

Children learn through experience. Board games such as Monopoly, The Game of Life, and Payday teach lessons about budgeting, investing, and decision-making. Mobile apps like Greenlight, FamZoo, and Mint apply gamification to make saving, giving, and spending enjoyable and engaging. Saving challenges, such as a piggy bank to fill or a 52-week savings challenge, enable children to establish and meet financial objectives. Simulated investing and practice accounts enable older children and teenagers to test stocks and mutual funds without actual risk.

5. Delegating Chores and Allowances to Develop Work Ethic

Linking chores to allowance allows children to see the connection between work and getting paid. As children age, teach them to save part of what they earn, spend some, and donate a little bit to charity. Charles Schwab says linking allowance to chores allows children to build a strong work ethic and sense of responsibility. Allow children to make their own spending choices—even if they fail—so they will learn from experience.

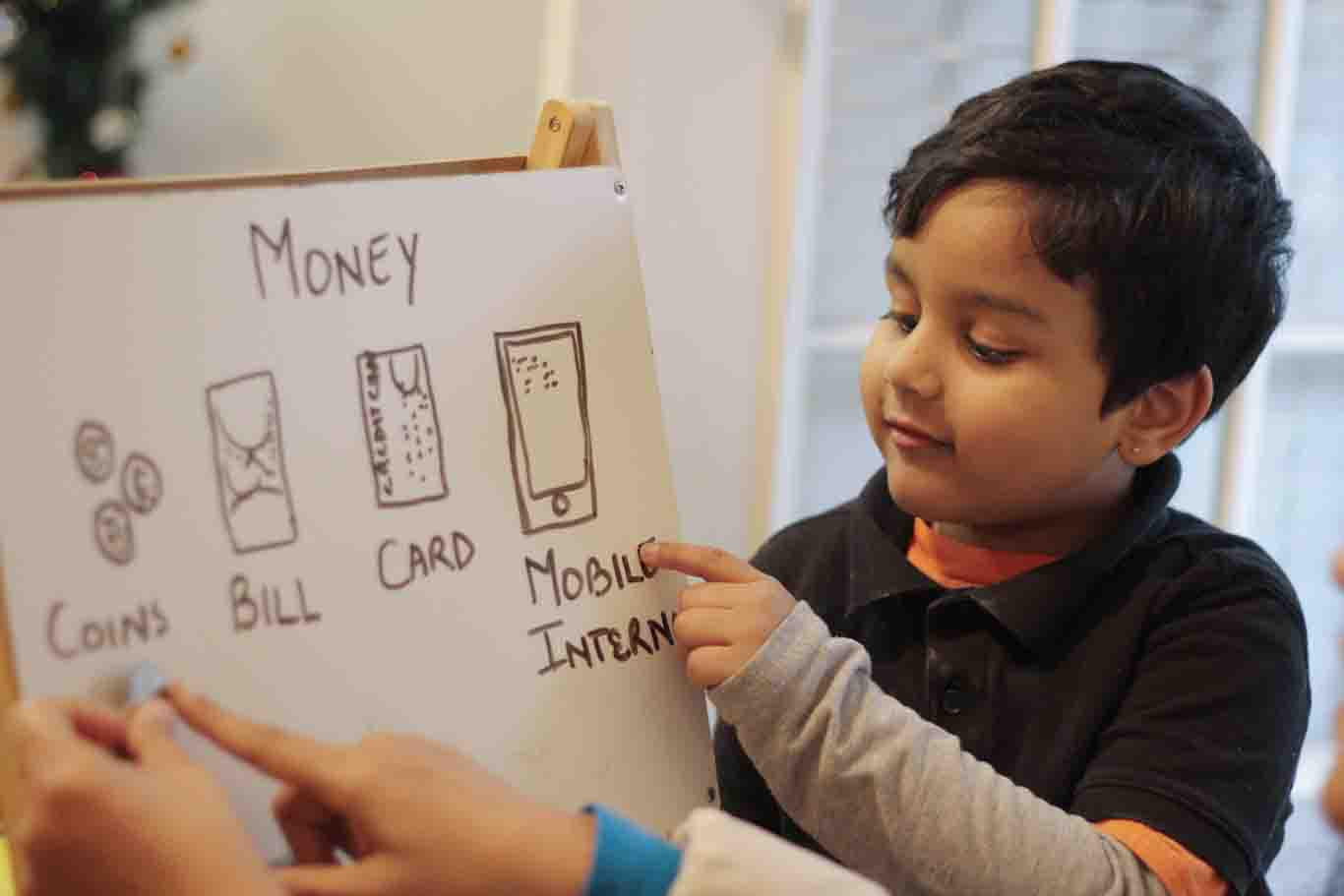

4. Individualize Lessons for Every Age Group

Begin with simple concepts using toddlers and preschoolers by educating them on the names and worth of coins, and having them spend play money in imaginative stores. For school-age children, use saving, spending, and giving jars, and establish a savings account to demonstrate how money can grow with interest. Preteens are ready for more advanced subjects, such as saving up for a wanted item, determining savings goals, and learning the distinction between wants and needs. Teens need to know about credit, investing, taxes, and balancing a checking account.

3. Model Good Financial Habits

Kids learn more from what you do than what you tell them. Pay bills promptly, save consistently, and don’t make impulse buys. Be transparent about your financial choices, telling them why you select one choice over another. If you give to charity or save for retirement, make the process of making those decisions visible and involve your children in those decisions. It is one of the most effective means of educating children about money, according to the Institute of Financial Wellness.

2. Maintain Open and Frequent Money Conversations

Don’t make money a forbidden subject. Honest, regular conversations about money make children feel free to ask questions and get guidance. U.S. Bank says that open, transparent, and honest discussions about money have numerous advantages, such as fostering trust and financial confidence. Take everyday circumstances—such as shopping, paying bills, or vacation planning—as chances to discuss budgeting, saving, and decision-making.

1. Begin Early—It’s Never Too Early

Habits of money are developed earlier than people know. According to research conducted by the University of Cambridge, children start to develop money habits at age seven. Toddlers can even be taught simple ideas, such as getting money in exchange for products and the need to save. The earlier you begin, the longer your child has to learn and instill healthy money habits that will last a lifetime.