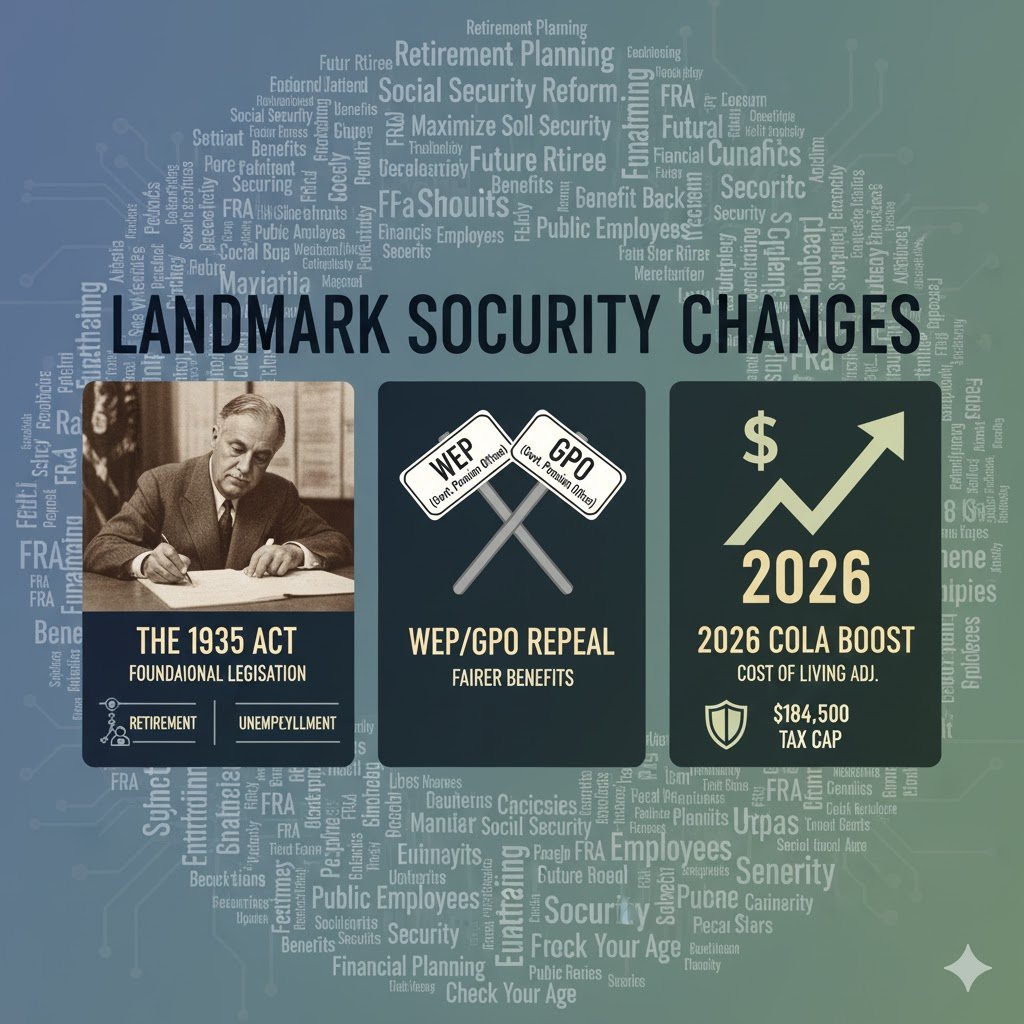

New York: 17-11-2025] The financial foundation of millions of Americans is depends on the Social Security Act, and recent amendments, both legislative houses and the dramatically restructuring the retirement criteria. This article covers the essential background of the main Act and details the most important changes which may impacting the current beneficiaries and future retirees.

Understanding the Main Legislation: The Social Security Act of 1935

At its centre, the U.S. Social Security system is governed by the Social Security Act (SSA) of 1935, signed into law by President Franklin D. Roosevelt. This landmark legislation established a federal system of social insurance to provide economic security for American workers.

The Main Benefit (OASDI)

The SSA’s primary and most recognisable component is the Old-Age, Survivors, and Disability Insurance (OASDI) program.

Benefit: Old-Age (Retirement), Description & Purpose: Provides a steady income stream for workers and their dependent in retirement, based on a worker’s lifetime earnings.

Purpose: To replace a portion of income lost due to old age.

Benefit: Survivors, Description & Purpose: Provides benefits to the spouse and dependent children of a deceased worker who was covered by Social Security.

Purpose: To prevent the immediate financial loss of a dependant family due to the death of a worker.

Benefit: Disability, Death compensations

Description & Purpose : Provides monthly payments to workers who have a severe physical or mental impairment that prevents them from working for a year or more, and to their families.

Purpose: To replace a portion of income lost due to disability.

The main benefit of the Act is to provide a social safety net, a foundation of income that workers and their families can rely on when they retire, become disabled, or die.

Recent Important Changes to Social Security Law in year 2026

Recent years have brought two major types of changes, a significant, permanent legislative act and the annual, automatic adjustments for 2026.

1. The Social Security Fairness Act: WEP and GPO Repealed

The most important legislative change is the passage of the Social Security Fairness Act (SSFA), which has permanently repealed the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). This change became effective for benefits payable after December 2023.

- WEP Impact: This ends the reduction of Social Security benefits for individuals who receive a non-covered pension (i.e., a pension from a job where they did not pay Social Security taxes, like many public school teachers or police officers).

- GPO Impact: This ends the reduction of spousal or survivor Social Security benefits for individuals who receive a non-covered pension.

The repeal provides a substantial financial boost to approximately 3.2 million beneficiaries who were previously penalised, including a wave of one-time retroactive payments made for benefits withheld in 2024.

2. The 2026 Annual Program Adjustments

The Social Security Administration (SSA) makes several non-legislative, automatic changes each year based on inflation and average wage growth. The key changes for 2026 are:

A. Cost-of-Living Adjustment (COLA)

The Change: Social Security benefits will increase by 2.8% starting in January 2026. This is the Cost of Living Adjustment (COLA), designed to keep pace with inflation (measured by the CPI-W).

The Impact: The average retired worker’s monthly benefit will increase by an estimated $56, raising the average monthly benefit to around $2,071/-.

B. Higher Taxable Maximum Earnings (Tax Cap)

The Change: The maximum amount of earnings subject to the Social Security payroll tax (FICA) is increasing to $1,84,500/- in 2026 (up from $1,76,100/-).

The Impact: High-income earners will pay Social Security tax on an additional $8,400 of their salary. This increase also means the maximum possible Social Security benefit for a worker retiring at Full Retirement Age is increasing to an estimated $4,152/- per month in 2026.

C. Higher Retirement Earnings Test Limits

The Change: The amount that early retirees can earn from work before the SSA temporarily reduces their benefits is increasing. The limit for those under Full Retirement Age (FRA) rises to $24,480/- per year.

The Impact: This allows individuals who claim benefits before their FRA to work and earn an extra $1,080 in 2026 without having their Social Security checks affected.

Retiree Action Item

While the repeal of WEP and GPO is a massive, positive shift for many public sector workers, the annual COLA for 2026 will be partially offset by rising healthcare costs. The estimated increase in the Medicare Part B premium to approximately $202.90/- per month will consume nearly 40% of the average retiree’s COLA increase.

All beneficiaries should closely review the official COLA notice from the SSA in December to understand their net benefit amount for 2026.

Also, Following is the detailed information on the Full Retirement Age (FRA) chart and the impact of the new $1,84,500 tax cap for high earners.

1. Full Retirement Age (FRA) by Birth Year

Your Full Retirement Age is the age at which you are entitled to 100% of your primary Social Security benefit. Claiming before this age results in a permanent reduction, while delaying past this age (up to age 70) earns you higher benefits through Delayed Retirement Credits.

The Full Retirement Age gradually increases from age 66 to age 67, based on your birth year:

Year of Birth : 1943–1954, Full Retirement Age (FRA): 66 years old

Year of Birth : 1955 Full Retirement Age (FRA): 66 years and 2 months

Year of Birth : 1956 Full Retirement Age (FRA): 66 years and 4 months

Year of Birth : 1957 Full Retirement Age (FRA): 66 years and 6 months

Year of Birth : 1958 Full Retirement Age (FRA): 66 years and 8 months

Year of Birth : 1959 Full Retirement Age (FRA): 66 years and 10 months

Year of Birth : 1960 and later Full Retirement Age (FRA): 67 years old

Note: If you were born on January 1st of any year, the Social Security Administration (SSA) treats your birth date as though it were in the previous year for the purpose of calculating your FRA (Full Retirement Age).

2. Impact of the New $1,84,500/- Social Security Tax Cap (2026)

The Social Security system is funded by the FICA (Federal Insurance Contributions Act) payroll tax, and a key component is the annual taxable maximum, which is also known as the wage base limit.

For 2026, the maximum amount of earnings subject to the 6.2% of Social Security payroll tax is rising to $1,84,500/- (up from $1,76,100/- of 2025).

How This Affects High Earners:

Increased Tax Bill: Any high-earning individual will pay Social Security tax on an additional $8,400/- of income in 2026.

Since the employee Social Security tax rate is 6.2% this translates to an additional tax of approximately $0.062 times $8,400 = $520.80 in 2026 for a high-earning employee.

Self-employed individuals, who pay both the employee and employer portions (12.4%), will see a tax increase of approximately $1,041.60.

The “Tax Cap” Principle: If an employee earns, for example, $2,50,000/- in 2026, they will stop paying the 6.2% Social Security tax once their cumulative earnings hit the $1,84,500 cap. Their income above that cap ($65,500) is not subject to the Social Security portion of the FICA tax.

Higher Future Benefit: The positive side of paying tax on a higher earnings cap is that your lifetime earnings record is increased. Since Social Security benefits are calculated based on your highest 35 years of indexed earnings, a higher tax cap allows high earners to qualify for a higher maximum benefit in retirement. The maximum monthly benefit for a worker retiring at Full Retirement Age in 2026 is projected to rise to $4,152/- per month.

No Cap on Medicare Tax: It is important to remember that this cap only applies to the Social Security (OASDI) portion of the FICA tax. The Medicare portion (1.45% for the employee) is taxed on all earnings, with no wage limit.

Social Security changes, Social Security reform, Historic Social Security, Landmark Social Security, Retirement planning, Financial planning, Social Security Act of 1935, WEP repeal, GPO repeal, Windfall Elimination Provision repeal, Government Pension Offset repeal, COLA & Tax Cap, 2026 COLA, COLA increase, Cost of living adjustment, Social Security tax cap, $184,500 tax cap, social Security benefits, Social Security beneficiaries, Retirees,

Future retirees, Public employees, Teachers pension, Government workers, Retirement age, How will the WEP/GPO repeal affect my Social Security?, What is the 2026 Social Security COLA boost?, New Social Security tax cap 2026, Impact of 1935 Social Security Act, Full Retirement Age (FRA) changes, Social Security updates, Understanding Social Security benefits, Maximizing Social Security, Social Security news, US Social Security, Check Full Retirement Age, Social Security calculator,